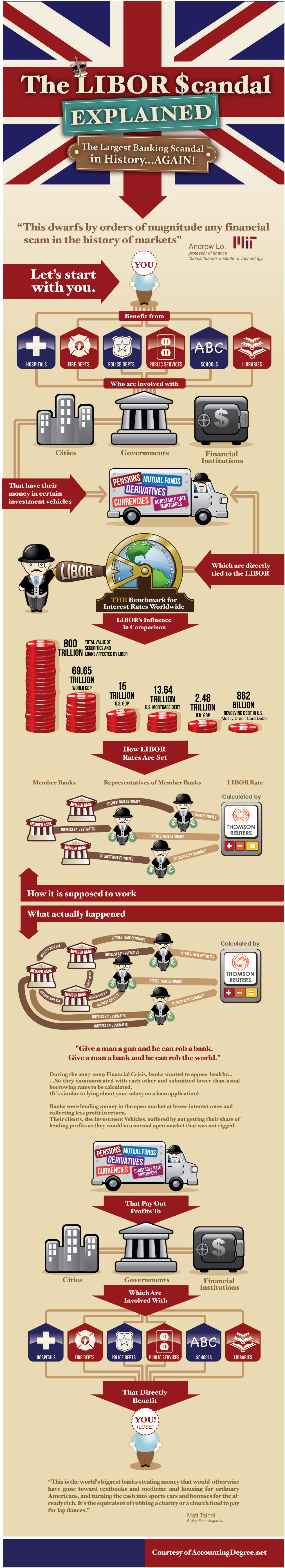

The LIBOR Scandal Explained

Spread The News

Use the social buttons to the right to share on popular social sites. If you have a blog or other website, copy the below code and paste it into your website.

Full Width Infographic

600 Pixel Wide Narrow Version

How Does This Impact Me?

In addition to having municipalities receive lower returns on their loans around the time of the financial crisis, it appears that US home buyers may have been scammed out of nearly a half-trillion Dollars on overpriced mortgage payments:

Early analysis suggests that for a period of several years before and after the 2008 financial crisis, the London interbank offered rate (LIBOR) was manipulated to such an extent that a family with a $100,000 mortgage would have been $50 to $100 worse off a month because of the fixing.$100/month per family x ~100 million families = $10 billion stolen per month in the United States alone.

Or $120 billion per year. For several years.

In the United States alone this is quite-plausibly a half-trillion dollar heist.

By fixing LIBOR rates (high or low) & using leverage on derivative investments, there are a near infinite number of ways for banksters to skim trillions of Dollars from the productive economy.

How Exactly Are Libor Rates Calculated?

Every year the Foreign Exchange and Money Markets Committee, a part of the British Bankers' Association, selects 'panel banks' using the criteria of volume, activity, credit worthiness, and currency proficiency. These panel banks are asked how much interest they think they would be charged by other banks if they were to borrow money in certain currencies and over certain periods of time.

The panel banks, or 'contributor banks', submit their perceived borrowing rates between 5:00am and 5:10am EST to their 3rd party calculating agent, Thomas Reuters. The contributor banks have software provided by Thomas Reuters to easily submit rates.

Thomas Reuters collects the rate information from all contributor banks, takes out the top 25% and bottom 25%, and averages the middle 50% to be the actual Libor (bbalibor) rate. For example, if 18 contributing banks each submit 1 rate to be calculated, the top 4 and bottom 4 rates will be dropped and the average of the remaining 10 rates will be calculated.

When Are Libor Rates Published?

Around 12 noon London Time. The rates can be viewed by companies with certain tiers of licensing through the British Bankers' Association.

Where Can I See the Daily Libor Rates?

You can view them online at websites which are licensed to publish rates. These will not be in real-time; usually there is a slight delay. One example is at:

http://www.global-rates.com/interest-rates/libor/libor.aspx

What Banks Are Involved with Setting the Libor?

Depending on the currency involved with the rate, between 6 and 18 contributor banks.

For example, here are the current 18 panel banks for the US Dollar:

- Bank of America

- Bank of Tokyo-Mitsubishi UFJ Ltd

- Barclays Bank plc

- BNP Paribas

- Citibank NA

- Credit Agricole CIB

- Credit Suisse

- Deutsche Bank AG

- HSBC

- JP Morgan Chase

- Lloyds Banking Group

- Rabobank

- Royal Bank of Canada

- Société Générale

- Sumitomo Mitsui Banking Corporation

- The Norinchukin Bank

- The Royal Bank of Scotland Group

- UBS AG

How Many Libor Rates Are There?

There are 15 separate maturities, with 10 separate currencies for each, equaling 150 different Libor rates.

The lengths of maturity are:

- 1 day

- 1 week

- 2 weeks

- 1 month

- 2 months

- 3 months

- 4 months

- 5 months

- 6 months

- 7 months

- 8 months

- 9 months

- 10 months

- 11 months

- 12 months

The currencies are:

- American Dollar - USD

- Australian Dollar- AUD

- British Pound Sterling - GBP

- Canadian Dollar- CAD

- Danish Krone - DKK

- European Euro - EUR

- Japanese Yen - JPY

- New Zealand Dollar - NZD

- Swedish Krona - SEK

- Swiss Franc - CHF

Surely This Has Ended???

Not so much.

While Libor is to be phased out by the end of 2021, the transition to another reference rate has gone slowly as SOFR has had a number of issues & many new contracts do not contain fallback language.

And ultimately no matter what index is used there will still be attempts to game it & ultimately there are a limited number of global financial institutions which engage in certain financial transactions. To this day municipalities continue to work with financial firms they've previously accused of fraud.

Philadelphia Hands Bond Deal to Banks It Says Have Fleeced the City - April 26, 2019

Want to Learn More? Check Out These Great Resources

- http://en.wikipedia.org/wiki/Libor_scandal

- http://www.americablog.com/2012/07/libor-for-laymenwhat-is-it-and-why.html

- http://www.guardian.co.uk/business/2012/jun/28/barclays-libor-scandal-question-answer

- http://money.cnn.com/2012/07/03/investing/libor-interest-rate-faq/index.htm

- http://www.rollingstone.com/politics/news/the-scam-wall-street-learned-from-the-mafia-20120620

- http://www.rollingstone.com/politics/blogs/taibblog/why-is-nobody-freaking-out-about-the-libor-banking-scandal-20120703

- http://www.telegraph.co.uk/finance/personalfinance/consumertips/banking/9359744/Barclays-how-does-Libor-affect-my-mortgage.html